If your employees or their families are affected by COVID-19, you can pay them sick leave and apply a credit to your payroll taxes.

We have added new pay types to track what you’re paying employees.

Before you can give your employees this sick leave, you first need to figure out what pay leave type they fall under and their hourly rate.

Pay leave type

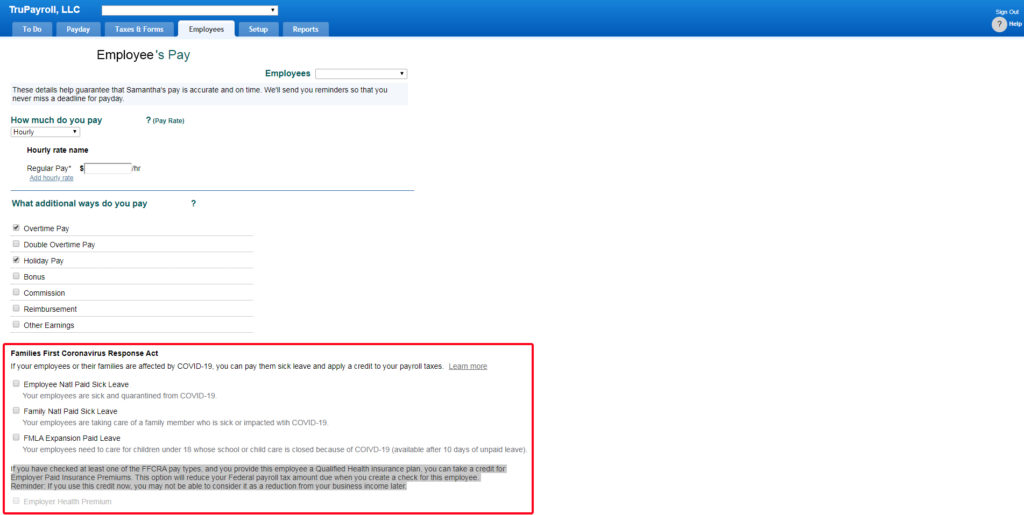

Under FFCRA, there are three different types of paid leave.

Employee National Paid Sick Leave: Your employee is sick and under quarantine with COVID-19.

Family National Paid Sick Leave: Your employee is taking care of a family member who is sick or impacted with COVID-19.

Family Medical Leave Act Expansion Paid Leave: Your employee is taking leave under the Family Medical Leave Act (FMLA) to care for children under 18 whose school or child care is closed because of COVID-19.

Hourly rate

In most cases, pay employees the hourly rate they’ve been paid over the last 6 months. However, there are a few exceptions that are in line with the regular rate of pay under the Fair Labor Standards Act (FLSA).

Employees on commission

Create an hourly rate for commissioned employees. The hourly rate under the FFCRA needs to be equal to the commission paid over the last 6 months divided by their hours worked.

Tipped Employees

Be sure employee’s tipped income is included when entering paid leave or FMLA expansion pay. Review the amount of income a tipped employee received over the last six months, and then average it out over the number of hours worked in the same period. Don’t forget to change the employee’s pay rate during this time and ensure they’re paid at least minimum wage required under the FLSA, state, or local jurisdiction.

How to make changes to employees pay types within TruPayroll:

1. Go to Employees tab.

2. Select the employee you’d like to add paid leave to.

3. In the Pay section of the Employee Overview screen click the Edit button

4. In the What additional ways do you pay your Employee section, select the correct paid leave type as described in Step 1 under the Families First Coronavirus Response Act section,

5. Select and Enter any Employer Paid Health Insurance Premium amount to be tracked on each check created for National Paid Sick Leave or FMLA Expansion for this employee, if applicable, and select OK.

Review the effects on taxes

After you’ve run your payroll with the paid leave, you should be aware of how it affects your taxes. Under the FFCRA, you’ll get credit towards your Federal Tax deposit for the wages paid under this act.

To ensure you’ve been tracking the leave correctly, you can review your payroll reports to see how many hours you’ve used in these tax credits. Tax credits will automatically apply to your liability.

The reports that you’ll see these tax credit include:

– Payroll details report

– Payroll Summary report

– Tax Liability report

If you have checked at least one of the FFCRA pay types, and provide employee/s a Qualified Health insurance plan, you can take a credit for Employer Paid Insurance Premiums. This option will reduce your Federal payroll tax amount due when you create a check for this employee.Reminder: If you use this credit now, you may not be able to consider it as a reduction from your business income later.